The year 2021 has been tough on crude oil tanker freight rates across the board so far. Consequently, the industry buzz has been all about large scale scrapping of tankers, but so far, it has been all talk and very little walk, as the second-hand market has proved a much-preferred alternative.

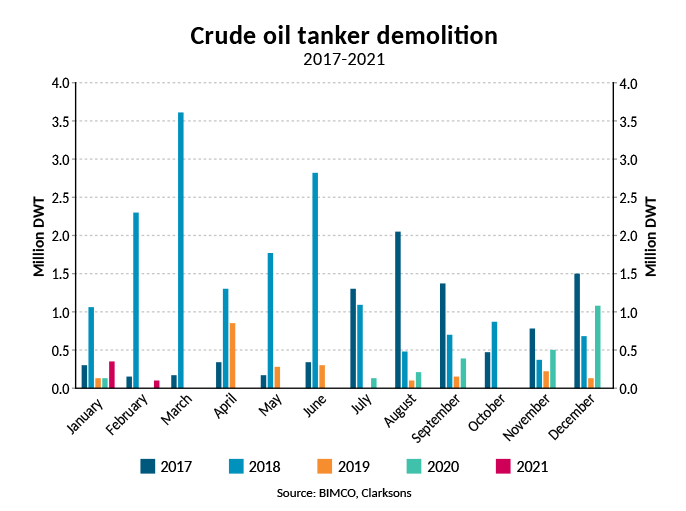

Although demolitions are up from the start of last year, only two shuttle tankers and two Aframax crude oil carriers (0.45m DWT) have been confirmed demolished in the first two months of 2021, according to data from Clarksons. This is significantly down from the 1.1m DWT of crude oil tanker capacity that left the market in December 2020.

“Despite the widely disappointing crude oil tanker freight rates at the start of 2021, owners appear to be in no hurry to reduce the cargo carrying capacity in the market by selling ships for demolition.

The attractiveness of scrap steel prices around USD 450 per ltd. offered by breaker yard on the Indian sub-continent, easily vanish when compared to USD 24.5 million being paid for a 2002-built VLCC in the second-hand market,” says BIMCO’s Chief Shipping Analyst, Peter Sand.

Why is excess capacity not instantly removed?

“Often, demolition volumes rise when freight rates fall, but it is not always that simple. Earnings must remain in the doldrums for an extended period before demolition activity picks up significantly,” says Sand.

For instance, in Q4 2014 through Q1 2016, tanker freight rates enjoyed high levels on the back of a sharp decline in oil prices during Q4 2014 to Q1 2015, but when tanker freight rates started to drop after Q1 2016, it took around five quarters for scrapping activity to pick up in July 2017.

Same-same but different:

Every crisis holds elements of something that we have seen before, in addition to elements that are new to us. The most striking recognisable element of the current crisis is that a lot of money was made before it all went sour, while the most striking new element seems to be the fact that demand is very different.

We currently observe two opposing future trends, both of which will steadily impact tanker trade lanes. Where non-OECD nations (mainly India, China and South East Asia) are rapidly heading towards a pre-pandemic level of oil demand, OECD nations on the other hand are on a very different track as the US is now joining Europe and Japan on a trend of a decline in the demand for oil.

Entering the seasonal lows for the year:

2021 may not be about seasons at all; leaving the winter peak season behind us now, we can only look back at it as a non-event. The Asian refinery maintenance season is currently underway, but it will most likely become another regular element that will only be noticed to a small extent this year.

Source: Hellenic Shipping