Europe has already cut down on gas

Europe has already cut down on gas

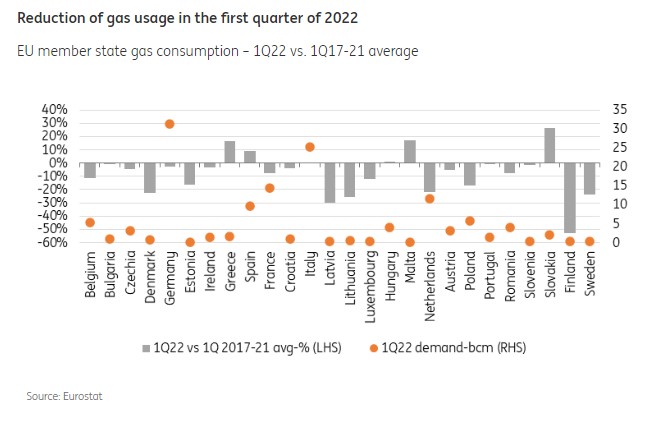

Overall gas demand in Europe has come down substantially this year. During the first quarter, gas demand in Europe fell by about 5% compared to the 2017-21 average, partly due to a mild winter. Prices rose further in the second quarter and fuel switching began, so the decline in the second quarter was stronger. Germany, for example, reports that gas demand is down 10-15% compared to the 10-year average in the second quarter, and The Netherlands stood at -30% compared to the 2019-21 average. It shows that many countries have already come a long way in bringing gas demand down.

Substitutes have been found

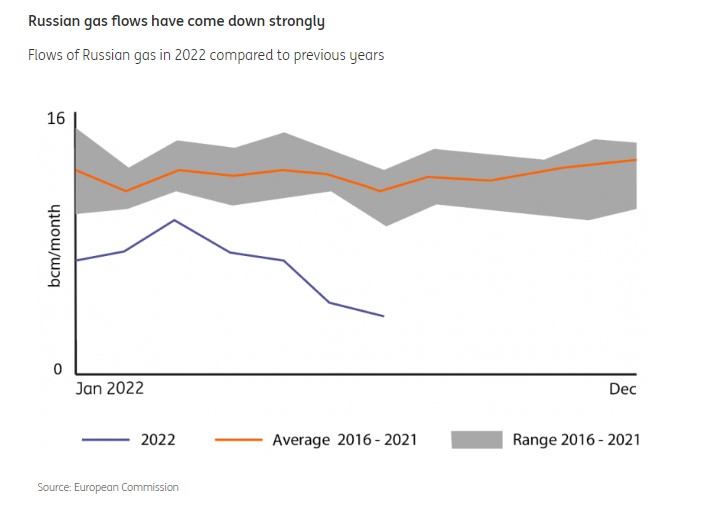

The same goes for finding substitutes. The flow of Russian gas to Europe has come down strongly over the first two quarters of this year – on average it has just about halved and recently it stood at as little as a third of normal flows (see graph).

The decline in Russian flows is the equivalent of about 15% (quarter one) and about 25% (quarter two) of total gas used in Europe historically, as Russian gas is about 40-45% of total gas used. This makes it evident that alongside lower demand, the Continent has been able to substitute a large share of Russian gas with alternatives. Liquefied natural gas (LNG) has been the most prominent, alternative pipeline flows a second, while fuel switching to coal and oil has also contributed. Renewables play a role when compared to the longer-term historical average use too.

More substitutes will become available over time

The crucial question is of course how much of the flow can be substituted. The European Commission’s estimate is that about 60% of Russian gas can be replaced by other energy sources in one year. This makes sense since substitution has been high already and more LNG terminals are being constructed, and more solar and wind power is being installed. We have also seen the debate on fuel switching change rapidly over time. The reopening of coal-fired power plants is now acceptable, and extending the life span of nuclear power plants is no longer taboo in Germany. Reopening the Groningen field is still a no-go in The Netherlands, and the Commission makes no mention of it, but the economic impact of high gas prices for households, and the need to compensate corporates for a lack of gas or automatic stabilisers, which is worsening the government budget, might be offset by the possibility of sky-high returns from Groningen gas for the Dutch state at some point.

Further demand reduction helped by Russia

The current voluntary goal of bringing down gas demand by 15% compared to the historical average, was chosen for a reason. It would offset the remaining gas required from Russia. The 40-45% dependence and the alternatives amounting to about 60% of that, implies 15% of total gas demand not being met. Ironically, the decision by Russia to cut the gas flow through Nord Stream 1 back to 20% again, will help governments reach this goal. It leads to price levels where the market will cut down on demand by itself. So the chance of governments rationing supply may have fallen. Industrial players will decide whether they are still willing to pay the price. As long as they are, they will likely get it. The rest of the world will probably be less willing to pay the same price, as they may have alternatives such as coal at their disposal.

One question is to what extent governments will allow households to be incentivised by prices to lower thermostats and insulate their homes. Winter usage of gas is much higher mostly because of heating demand. Shielding households from higher prices may offset the economic consequences via purchasing power, but will keep up gas demand, which will lead to higher gas prices for all other players, most notably industrial users. This would also negatively impact the cost of living via other energy-intensive products as well as slowing down industrial activity. The price for more expensive gas will have to be paid either way.

The solution may depend on whether socially undesirable effects of costly gas (a high share of spending for lower-income households) can be prevented, while higher-income households would get sufficient incentives to limit their consumption. Remember, higher-income homeowners will often have larger homes, so will use more gas than the average household. Capping energy prices is saving them more money than poorer households. Hungary has reshaped its utility bill support scheme for gas and electricity so that households that are using more gas on a yearly basis than the average household must pay the extra usage at close to the market price. This is seven-times higher than the price for below-average consumption. This may lower the second-round effects, as the financial impact on higher-income households would be mitigated by lower savings.

The strategic game

The crucial question is of course whether gas flows will continue to be interrupted. One could argue that in the face of credible plans to bring down gas use in Europe, the attractiveness of no longer supplying that gas from a Russian perspective falls. Alternatively, cracks in solidarity between European countries would make attempts to try to divide and rule more attractive. So European solidarity is important either way: it helps mitigate the impact of a further reduction in gas supply, but may prevent it from happening altogether. Also, the longer it takes for a cut in flows to happen, the lower the effect as alternatives will be available and storage will have been filled. All parties involved will be aware of this. We expect to witness a game of poker being played out in front of us.

What is at stake for sectors?

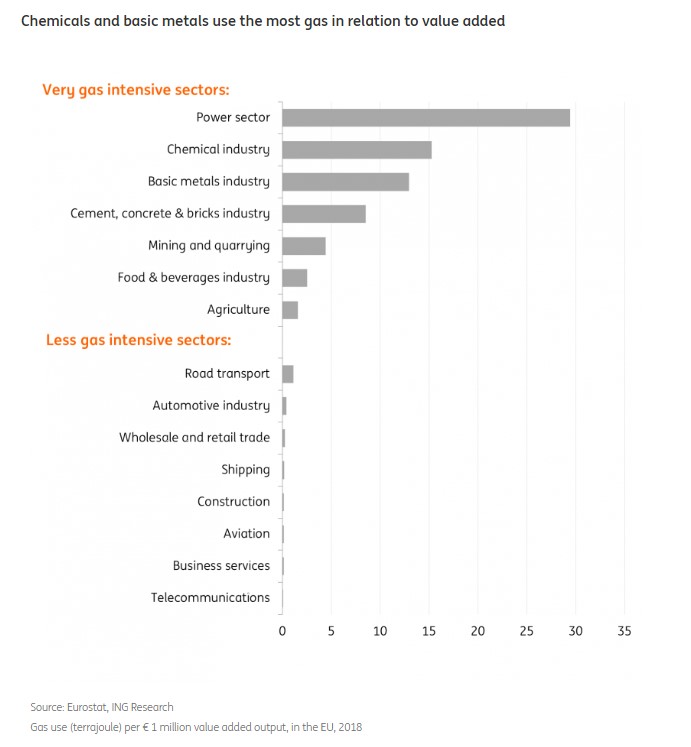

Clearly, the heavy gas users are most susceptible to higher gas prices. Besides the power sector, exposure is highest in some parts of manufacturing, mostly chemicals and basic metals.

Gas-intensive sectors (excluding the power sector) account for roughly 6% of GDP in the EU. Because these sectors are situated at the beginning of many supply chains, a drop in production will cause all kinds of second-round effects in other sectors due to higher input costs and supply shortages. Some companies in the EU have already (partially) curtailed production at industrial sites in Europe (e.g. Yara, Aldel). In the event of higher prices and further gas rationing, more companies will do the same. Still, demand for these intermediate products or finished goods will not disappear so it will lead to higher import demand. Energy-intensive production of chemicals can be done elsewhere and the products – fertiliser, for example – can be bought abroad. This will negatively affect GDP but will mitigate the second-round effects in supply chains.

Of course, these are not the only sectors that will be hit. Via the purchasing power of households, many others will also be affected via lower demand. Sectors oriented toward consumers, especially those providing luxury goods for lower-income households, are likely to suffer too. While a deteriorating economic situation is negative for every sector in the longer term, there are some sectors which are likely to experience increased demand for their services, including shipping, mining and renewable energy, as well as subsectors within business services (like industrial contracting). The longer the higher energy prices in Europe last, the more pressure it puts on competitiveness in Europe. The current situation is an incentive for investment in production capacity in energy-intensive industries in other regions such as North America or the Middle East.

The impact on GDP from a country perspective

We expect to see a technical recession in Europe as the base case. Further significant cuts in the gas flows and/or voluntary additional demand reductions will get us to a full-blown recession. The question is exactly how bad it will be. The answer differs per country and according to their circumstances. First, we’ll look at the four countries the IMF sees as very vulnerable: The Netherlands, Germany, Italy and Hungary.

The Netherlands will mostly experience indirect effects

Dutch gas demand over the first quarter of 2022 was 22% below the five-year average for the period. Currently, it is down about 30%. Households are only a small fraction of the pie as they use only a small share (8%) of all gas consumed. Households are said to have lowered their thermostats, in part because they have benefited from a mild winter, leading to suppliers estimating them to have used 15-20% less gas. Industrial usage has also fallen, with the (petro)chemical industry reducing its gas use by more than 30%, and base metals by 10% compared to 2019 levels.

Power generation has also played a significant role: with gas usage coming down by approximately 40%, explained by lower electricity usage, higher imports, more use of coal-fired plants, and a rapid increase in wind and solar power over the last couple of years. Interestingly, overall industrial production held up well over the first quarter, while the chemical industry did see a decline (see graph below). Dutch gas transmission company Gasunie stated that with an assumed 25% demand reduction and a normal winter, The Netherlands would make it through this winter. This would still allow The Netherlands to supply Germany with a substantial amount of gas (35 billion cubic meters, or a third of Germany’s annual gas usage) according to its projection. So the direct impact in the case of a further reduction of gas flows seems limited. The remaining risks, however, are still significant, from a chilly winter, the effect on household consumption from higher energy bills, and the indirect effects via external demand and supply chain issues.

Germany will see households affected this winter

For Germany, the largest gas consumer in the EU, demand was only about 2% lower compared to a 10-year average over the first quarter. This number was helped by the mild winter, meaning industrial and household demand remained strong. Prices may have been less of an incentive then and long-term supply contracts still protected against price increases.

In Germany, gas suppliers like Uniper have been providing natural gas at a loss (which explains the difficulties faced by Uniper and the German government’s bailout of the company). Households are more relevant for gas demand in Germany than in the Netherlands (about 30% of gas is used by households, mainly for heating homes as around half of all apartments in Germany are still heated with gas) and so a crucial question is to what extent they will be incentivised by prices, especially when the heating season starts in autumn.

The industrial complex has brought down gas usage over the last three months, a period in which heating demand is not a significant part of the picture. The total gas demand was about 10-15% lower in the second quarter than historical usage, according to the BDEW power association. With the spot market price for gas skyrocketing, industrial companies that stock up on gas volumes at short notice have reduced gas consumption where possible. It does still seem as though Germany will be one of the more susceptible countries, as a substantial share of the effort required still must take place, especially by households who will gradually be hit by higher prices. We do, however, take some comfort from the possibility that The Netherlands could deliver a substantial additional flow and from the achieved demand reduction in the second quarter.

Italy is looking for substitutes

The latest available data show that gross domestic consumption of natural gas over the first five months of 2022 declined by 1.7% year-on-year in Italy over the same period of 2021. This shows that a lot more needs to be done, but the good news is that over the same period, imports of Russian gas declined by 33%, so there was some substitution.

The government has been very active in looking for alternative sources of gas supply. As some of the agreements already signed involve LNG, Italy has already purchased two floating LNG units, although the first of them will not be operational before the second half of next year. Other agreements signed involve higher imports through existing pipelines (Algeria has now overtaken Russia as the main gas source) and, on the local production front, pressure is being put on speeding up the increase of biogas production in agriculture. Existing coal plants might also be brought back to full capacity.

Lastly, Italy is performing decently on gas storage. The latest AGSI+ data shows that as of yesterday, Italian storage fields were 70.7% full. The target is 90% by the end of October. The Italian Government made some simulations of the effect of an interruption of the Russian gas supply starting in May 2022 and lasting until the end of 2023. The estimated impact on GDP in the worst-case scenario (whereby diversification in gas sourcing is incomplete) is a reduction in the GDP level of about 2% with respect to the trend level in 2022 and 2023. The analysis by the IMF shows that more than half of the impact on GDP (4% in total) would be due to spillover effects. The actual impact may be mitigated somewhat if Italy does in fact manage to substitute a relatively large degree of Russian supply.

Hungary is striking a deal

Hungary is one of the countries with a high reliance on Russian gas and an energy-intensive industrial complex. The main alternative supply routes go through constrained countries (Germany, Austria, Italy). Hungary is, however, mitigating the possible impact. It is trying to rework its agreement with Russia to move some flow from the Western line to the South (through Serbia). The physical capacity of the southern line would allow having a significant restructure of the flow, and in this case, if Western countries face shortages, Hungary would get the necessary gas via the uninterrupted pipeline. This pipeline is new, starting in September 2021.

Hungary is also filling up gas reserves as soon as possible. As mentioned above, it has reshaped the utility bill support scheme. It will increase domestic gas production, forbid energy carriers from being exported, and increase domestic coal mining as much as possible. Hungary may seem dependent more than others but it wants to mitigate the impact by directly dealing with Russia to secure gas flows. Here too the indirect impact will remain. Hungary is a small open economy and has strong ties to the German economy. In this regard, Hungary is quite sensitive to external shocks. Germany’s adjusted weight in export activity is about 50%.

Macro studies: assumptions matter

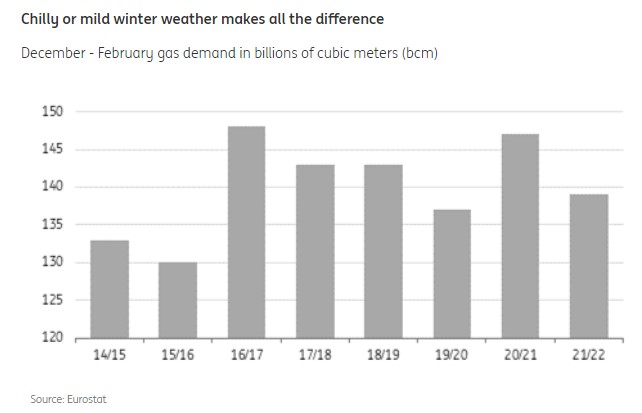

How can we put a GDP number on this? Different institutions have tried, but the problem is that there are so many variables to be considered that it is not easy to compare the estimates as they do not necessarily start from the same assumptions. Crucial assumptions are the pass-through of prices to users, the availability of alternatives such as LNG, the potential to increase imports of goods such as fertilisers, the behavioural response, as well as the compensating response by governments and the ECB. As previously mentioned, it also matters when the gas stops flowing. The later the better, as this provides time for preparations (building LNG terminals, filling up storage) and prices are increasingly passed through over time. Finally, the difference between a mild and a frigid winter (see graph) is the equivalent of about a tenth of Russian gas (or about 4% of total demand).

Existing estimates are all based on the situation prior to the war in Ukraine, while we have already taken a part of the hit already.

Estimates of GDP impact are all over the place

Bachman et al. tried to compute the impact for Germany of different energy scenarios. In the scenario of a 30% cut in gas supply (which implicitly assumes that about 25% of Russian gas would be substituted by natural gas from other suppliers), German GDP would take a hit of 2.2%. However, these estimates assume that the ECB would be able to keep inflation at bay and that there would be no turmoil in financial markets.

Using a similar hypothesis, David Baqaee et al. arrived at a GDP loss of only 0.25% for France, but this can be explained by the fact that France is much less dependent on fossil fuels than most other European countries. Using more sophisticated input-output models, where the shock would be spread over different countries, the negative impact for both France and Germany would be only around 0.2-0.3% of GDP.

Further building on the Bachman et al. methodology, the German Council of Economic Experts computed the negative impact of the Russian gas embargo on some other European countries, ranging from 0.03% of GDP for Spain to 2.2% for Italy.

However, a big caveat is that none of the models takes into account business cycle effects. Unemployment could rise and sentiment decline, amplifying the initial shock. Then again, government intervention could try to smooth this effect, just like it did during the Covid-19 pandemic.

Dullien et al. used the NiGEM model, which is also used by the OECD and the ECB, and which also includes transmission mechanisms via financial markets and central bank reactions. The study showed that an import ban on Russian gas could reduce German GDP by 6%.

The German Bundesbank probably published the most sophisticated analysis, using a NiGEM model for the external world and the Bundesbank’s own model, a linear sectoral input-output model, and various satellite models. The Bundesbank is obviously very reluctant to put precise numbers on several scenarios but concludes that the German economy could lose around 5% in a Russian energy embargo scenario in 2022, with GDP still 3.5 percentage points below baseline in 2023.

Depending on the degree of market integration, the IMF computed two scenarios for European countries: for the European Union as a whole the negative shock would be between -0.5% and -2.7% of GDP.

In its Spring Forecast, the European Commission concluded that in a severe scenario, where gas supplies from Russia would be cut and under the assumption of limited substitution, GDP growth would be cut by an additional 1.5 percentage points in 2022 and by around 0.75 percentage points in 2023.

An order of magnitude: 1-3% of GDP

If anything, the experience of the last two years has painfully shown that standard macro models are not really capable of adequately predicting the numerical economic implications of an unprecedented, once-in-a-lifetime and fully abrupt event with longer-term consequences and many interlinkages across sectors. Therefore, all current estimates have to be taken with a large pinch of salt. It simply remains impossible to put precise numbers on the impact. Having said all of this, and acknowledging that we are also expected to present at least some order of magnitude, we believe that the negative impact of a full embargo on Russian gas on the eurozone economy would be between 1-3% of GDP in the short run from here on.

That means after we have already seen a substantial impact as we highlighted above and with a significant difference in impact per country, and given that we are already expecting a mild recession, this would be enough to get to a full-blown recession. It is very clear that a full stop to Russian gas would hurt Europe. Trying to avoid it by jointly coming up with credible demand reduction plans is crucial.

Source: Hellenic Shipping News