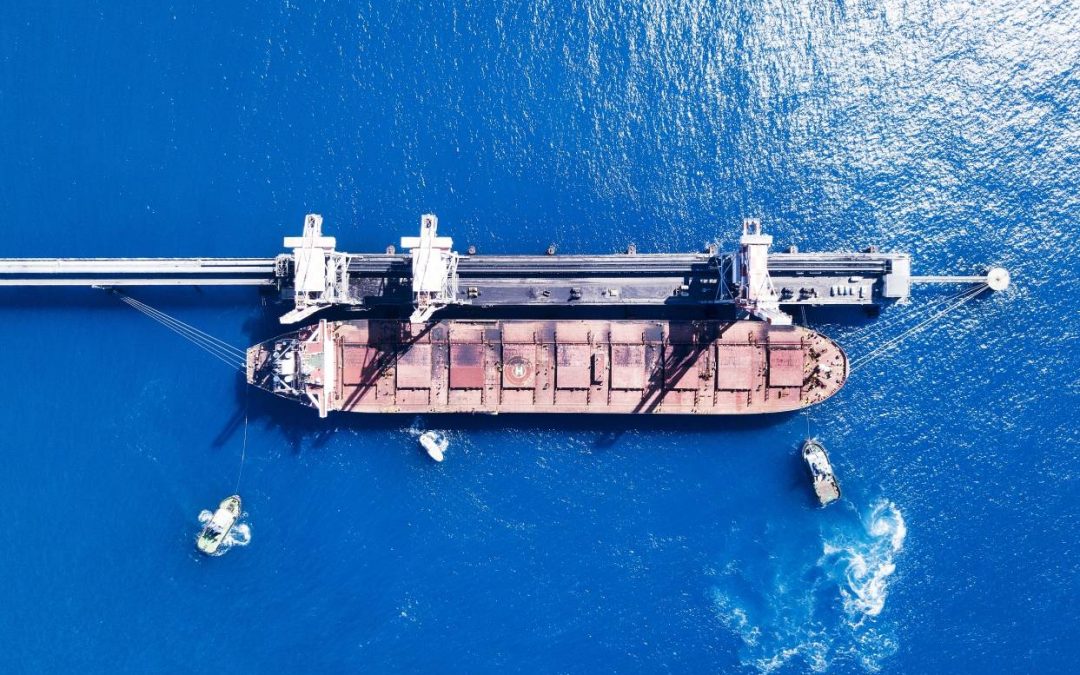

The Baltic Exchange’s main sea freight index (.BADI), tracking rates for ships carrying dry bulk commodities, fell for a third straight session on Wednesday as a dip in capesize rates outweighed gains in panamax and supramax segments.

The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, fell 8 points, or about 0.4%, to 1,799.

The capesize index (.BACI) fell 53 points, or about 2.5%, to 2,107, moving further away from a near two-month peak hit last week.

“The dry bulk market momentum remains positive with bigger sizes’ performance being subject to Chinese demand which has posted an increased volume of iron ore cargoes during the past days,” said shipbroker Intermodal in a weekly market report.

Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as coal and steel-making ingredient iron ore used in construction, were down $439 at $17,477.

The panamax index (.BPNI) rose 24 points to 2,022.

Average daily earnings for panamaxes, which usually carry coal or grain cargoes of about 60,000 to 70,000 tonnes, increased $219 to $18,201.

The supramax index (.BSIS) rose for the eleventh consecutive session, up 9 points to 1,680.

Source: Hellenic Shipping News