The dry bulk market is primed for a renewed upward momentum in the weeks and months to come. In its latest weekly report, shipbroker Allied Shipbroking said that “it has been a stellar couple of months for commodities, with prices and demand having risen at an ever faster pace as the global economy picks up steam. Iron ore has been grabbing much of the headlines, however equally impressive have been the gains noted in other major commodities such as coal and major grains. It is no surprise therefore that we see UNCTAD making large upward revision to its world trade growth forecasts for 2021 and 2022, with its latest figures now at 9.4% and 5.7% respectively”.

According to Mr. George Lazaridis, Allied’s Head of Research & Valuations, “the main driver thus far has been the remarkable speed with which China has been able to show a recovery in its economic activity and more importantly its industrial production. Most of the major developed economies have been now following suit, while the improvements noted in their respective consumer confidence and spending has helped drive an increase in global trade as the disruptions still faced on most supply chains have increased the need by most to over look any and all trade tariffs and hurdles so as to adequately meet demand”.

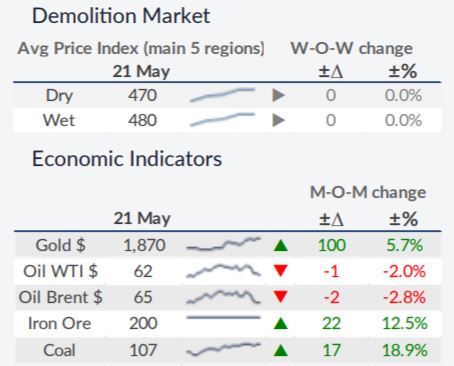

“Yet all this has led many to voice concerns as to the inflationary pressures that are starting to mount and in cases such as China, cause for governmental intervention so as to avoid what they see as mounting speculative behavior which could potentially lead to excesses in the market. In the case of Iron ore, this intervention took the form of the Chinese government saying that it would place great effort and focus in “cooling down” the soaring prices noted. This effort is said to focus on any monopolies present in its commodities markets as well as any “hoarding” that may be taking place. The signal was clear, with both iron ore and steel prices noting a fair drop, while prices of iron ore have now retreated considerably from their record high peak of just shy of US$ 230 per tonne earlier this month, to considerably below the US$ 200 per tonne mark. Yet despite the quick response by markets to such comments being made by China’s National Development and Reform Commission, it is hard to see to what extent they could actually influence the underlying market fundamentals at play right now”, Lazaridis said.

According to Allied’s analyst, “just as an indication to this, data issued by World Steel Association on Friday showed a 23% year-on-year jump in global steel production in April, climbing to 169.5 million tonnes. This may well be an exaggerated figure given that it is compared to the high point in closures last year. However, taking into consideration that the month-on-month increase was close to 3.5%, with the lower output by India being covered by large gains in China and other major steel producers, you quickly get a clear impression that this momentum still has steam left in it”.

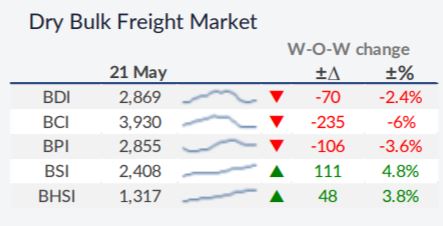

Lazaridis concluded that “as such the expectation is that we will continue to see output rise over the coming months despite any external pressure being placed. The basis for this seems even more solid when taking into consideration the fast paced global vaccination rollout, India’s drop in new COVID cases (we seem to have passed the peak) and Europe’s gradual full re-opening of business activities, all of which should push for renewed growth in global output fairly soon. For the moment however this slight softening in iron ore and steel prices has also been reflected in the downward correction noted in the Capesize freight market these past two weeks. That’s not to say that the freight market is underperforming, especially when considering that we are still holding at above US$ 30,000 per day and that the peak of US$ 44,817 on the 5th of May was a decade high point but rather that the question right now is not a matter of if it will stay high, but a matter of how high”.

Source: Hellenic Shipping