Critical of the European Union’s moves to recognize liquified natural gas as a green transition fuel for shipping, the NGO Transport & Environment issued a new analysis saying the EU’s policies are locking in fossil fuels instead of providing accelerated incentives for new green fuels. The group is calling on EU policymakers to hold true to the intent of the FuelEU Maritime proposals, which were designed to squeeze out fossil fuels and drive the uptake of sustainable fuels.

The NGO warns that a quarter of Europe’s shipping will be on LNG-fueled ships by 2030. With LNG being the least expensive currently available alternative fuel, the NGO says the EU’s policies are misguided and encouraging the uptake and continued use of LNG fossil-fueled ships. They contend that the drafts being considered by the European Commission will have little or no incentive to switch ships to more sustainable alternatives such as green hydrogen or hydrogen-based fuels. The current drafts they said do not provide a mandate for e-fuels, “meaning shipowners can rely on fossil LNG and dubious biofuels to meet EU targets into the 2040s.”

“Europe’s policymakers should introduce dedicated quotas and incentives to boost demand for hydrogen-based fuels,” said Delphine Gozillon, sustainable shipping officer at T&E. “Genuinely clean solutions do exist, but currently they are expensive. If we kick start demand now, a green shipping future is possible. Continue to waste precious time on fossil gas and it will start to look impossible.”

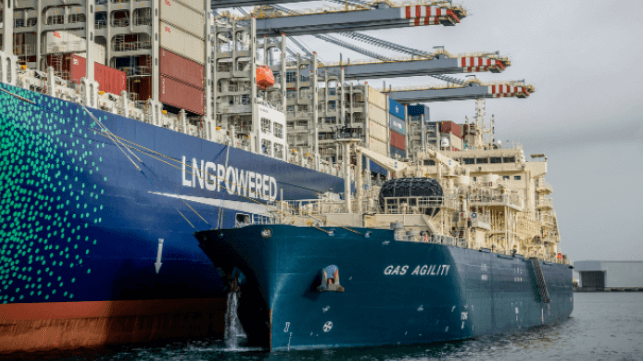

T&E estimates that fossil LNG-powered ships, which the regulation would permit to continue to operate into the 2040s, will make up 23 percent of the total energy used in EU shipping by 2030, up from six percent currently.

Last year was a record year for new shipbuilding orders for LNG-fueled ships. DNV, for example, reported that there were orders for 240 LNG-fueled ships in 2021, which was more than the previous four years combined. According to their tally, LNG-fueled ships in service and on order now account for nearly 10 percent of the global fleet with an additional three percent being LNG-ready.

“The old narrative of gas as transitional fuel just doesn’t hold,” said Gozillon who also blames the oil and gas industry for the increase in ships using LNG. “We cannot afford to shift from one fossil fuel to another. It will not get us to zero emissions by 2050 and, by putting more methane into the atmosphere may even fry the planet faster.”

T&E contends that many of today’s LNG ships are worse even than the traditional ships they replace. They based this argument on the fact that 79 percent of the ships in operation are burning LNG in low-pressure 4-stroke engines with “worse Well-to-Wake GHG emissions than traditional engines running on dirty fuel oil. If methane’s short-term global warming effects were accounted for, only the lowest-methane slippage engines would comply with FuelEU Maritime’s GHG targets,” contents the NGO.

Shipping industry executives and the LNG industry respond to these claims saying that it is outdated information. They say the new generation of engines and the use of high-pressure engines is greatly reducing or eliminating methane slip. The World Shipping Council in its proposals last week to the International Maritime Organization called for well-to-wake measurements as well as segmenting into two groups separating production and consumption to identify the areas of the supply chain for the greatest improvements in emissions.

T&E calling on the EU in its FuelEU Maritime regulations to mandate a six percent target for shipping e-fuels by 2030 “as the most straightforward way to ensure supply and demand for sustainable fuels, while providing business predictability to shipowners and fuel suppliers.” Without establishing a minimum share of e-fuels and stricter greenhouse gas targets, T&E argues that full decarbonization by 2050 will likely be out of reach.

The EU’s shipping fuel law – FuelEU Maritime – is currently under discussion in the European Parliament and the Council, with a final text expected in the second half of 2022. T&E calls on policymakers to adopt key changes to the proposal.

Source: The Maritime Executive