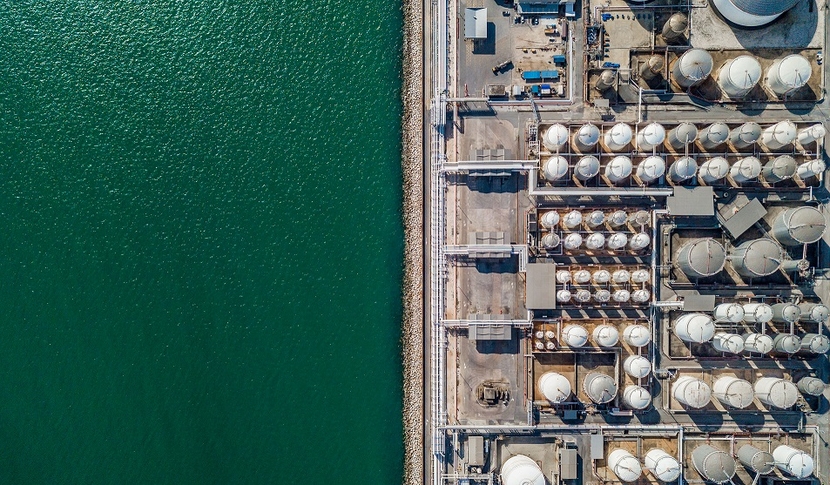

The recent agreement signed between Qatar Petroleum (QP), Singapore-based LNT Marine, the American Bureau of Shipping (ABS) and Shanghai Waigaoqiao Shipbuilding (SWS) for liquefied natural gas (LNG) carrier designs is the latest sign of a new surge in gas investment that is set to shape the small Gulf state beyond the football World Cup in 2022, says GlobalData’s MEED.

For the past ten years, the focus of Qatar’s investment has been on the development of the infrastructure needed to deliver the FIFA football World Cup in 2022, on the stadiums, the airports, rail and metro lines, and on leisure and hospitality facilities.

The World Cup has underpinned around $13.6bn a year of project contract awards in Qatar over the past decade, with the peak years coming in 2014 and 2015, when award levels rose to around $20.9bn and $17.4bn, respectively. Since 2015, however, awards have slowed, and questions have arisen about what comes after the World Cup.

Richard Thompson, Editorial Director of GlobalData’s MEED, comments: “Part of the answer came on 8 February 2021, when Qatargas awarded a $13bn contract for the main package of the first phase of its North Field Expansion (NFE) megaproject to a consortium of Japan’s Chiyoda Corporation and France-based Technip Energies. It is the biggest single EPC contract ever awarded in the region, and is redolent of the early 2000s, when investments to develop six large LNG trains propelled Qatar to become the world’s biggest gas exporter.”

Qatar’s new gas boom

Qatar’s projects market in the 2020s will have many similarities to the boom of the first decade of the 2000s and the similarity goes beyond LNG.

Another reminder came at the end of 2020, when Doha was selected to host the Asian Games in 2030. The Qatari capital hosted the games for the first time in 2006 and a range of major sporting and hospitality projects were completed ahead of the event.

Doha is implementing a new tourism strategy that it hopes will turn the one-off economic and political capital boost of the World Cup into a long-term driver of sports, business and leisure tourism.

Qatar National Vision 2030

Thompson continues: “This time around, Qatar’s gas projects come in parallel to the Qatar National Vison 2030, Doha’s long-term strategy to transition away from energy, diversify economically and attract investment.”

The plan includes the vigorous pursuit of investment in research and development in the hope of stimulating the formation of a broader knowledge economy.

Doha is also stepping up its efforts to draw investment through public-private partnership (PPP) schemes. Doha issued a new PPP law in May 2020. Doha has also been making progressive reforms with respect to worker welfare and its Kafala system, deemed necessary for Qatar’s future economy.

Source: Hellenic Shipping