Samsung Heavy Industries has announced its decision to outsource the construction of four Suezmax tankers (crude oil carriers) to Chinese shipyards, a strategic move aimed at addressing the current labor shortages and dock capacity issues faced by the company. This decision comes in the wake of a prolonged shipbuilding recession that began in 2016, which saw many skilled workers leave the industry. As the shipbuilding boom returned post-COVID-19, the supply of labor could not keep up with the surge in order volumes, prompting Samsung Heavy Industries to seek alternative solutions to meet delivery deadlines.

According to industry sources on Dec. 29, Samsung Heavy Industries is in the process of subcontracting with Chinese shipbuilder Paxocean for the construction of the Suezmax tankers ordered in November. The vessels are scheduled for delivery to the shipowner by December 2027. Given the scale of the order, which includes four tankers, Samsung Heavy Industries is also considering engaging other Chinese shipyards besides Paxocean to ensure timely completion.

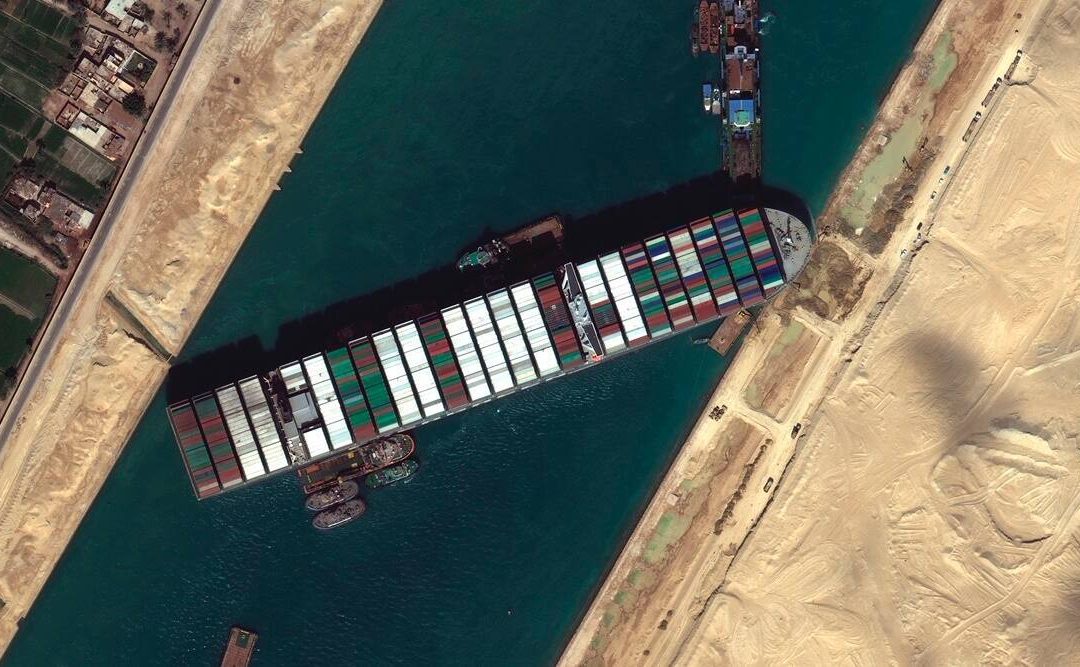

The construction method involves utilizing Chinese shipyard docks and labor, while Samsung Heavy Industries will handle the ship design and procurement of major equipment. To oversee the production on-site, the company plans to dispatch approximately 20 specialized personnel. Suezmax tankers, which are the largest ships that can pass through the Suez Canal, weigh approximately 160,000 tons. Despite their size, there is no concern about technology leakage, as Chinese shipyards already possess the necessary design and construction technology for tankers and bulk carriers.

Samsung Heavy Industries views this subcontracting strategy as advantageous in terms of price competitiveness. The cost savings in raw materials and labor make it possible to maintain profitability even with lower-priced orders. The company secured the order for the four tankers for $333.6 million (about 459.3 billion won), which translates to approximately $83.4 million per vessel. This price is lower than the usual order price of around $90 million. An industry insider commented, “If the Korea-China subcontracting strategy is properly established, it can be beneficial for Korea, China, and the shipowners.”

Historically, Korean shipbuilders have outsourced ship blocks to China due to labor shortages. This new construction strategy could provide a solution for the three major Korean shipbuilders, who have accumulated orders and are preparing various measures to secure production bases. For instance, HD Hyundai plans to utilize its shipyards in Southeast Asia actively, while HD Hyundai Mipo aims to expand the annual construction capacity of its shipyard in Khanh Hoa Province, central Vietnam, from 15 ships to 23 ships by 2030. HD Korea Shipbuilding & Offshore Engineering is leasing the Subic shipyard in the Philippines to produce ship blocks and offshore wind substructures. Hanwha Ocean recently acquired Dyna-Mac, a specialist in offshore facility topsides in Singapore, to strengthen its offshore plant production capabilities.

Unlike its counterparts, Samsung Heavy Industries has opted for the subcontracting method rather than directly establishing overseas production bases. This approach is expected to increase the variety of orders the company can handle. Korean shipyards have traditionally focused on high-value-added ships such as LNG carriers due to limited dock availability. With the increased availability of docks through subcontracting, they can expand orders to include tankers, bulk carriers, and container ships. The Suezmax tankers are the first type of ship that Samsung Heavy Industries has ordered this year. The company can now consider producing high-value-added ships in Korea and outsourcing lower-cost ships to China and other overseas locations.

A Samsung Heavy Industries official stated, “We will expand the subcontracting production and construction method to container ships and other types in the future,” adding, “If conditions permit, we will also cooperate with shipbuilders in Southeast Asia, not just China.”

Source: Business Korea