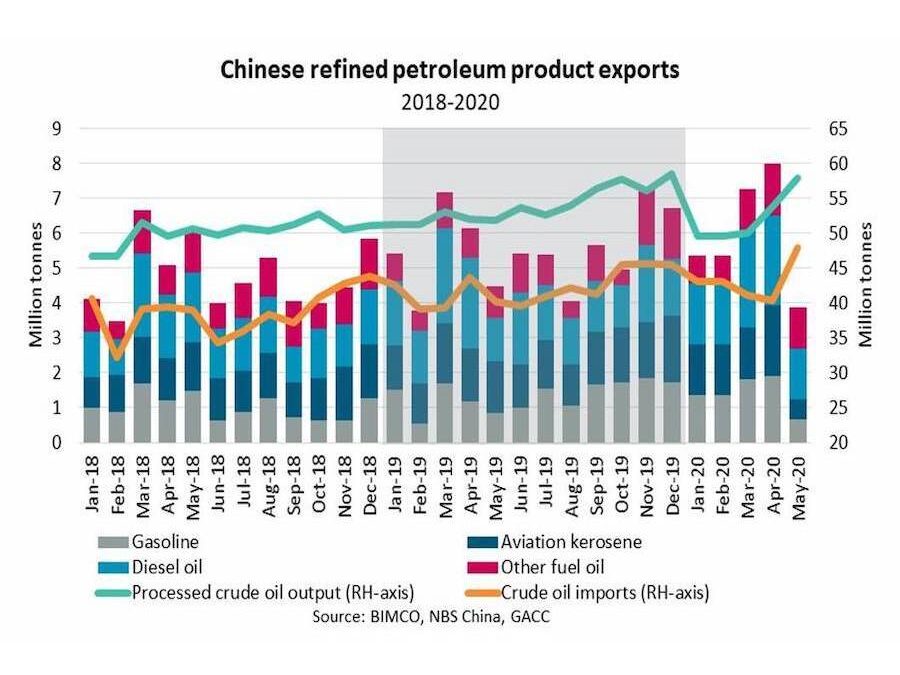

Exports of refined petroleum products from China declined by 51% month-on-month in May as the COVID-19 pandemic kept oil demand firmly depressed. Total volumes of refined petroleum products in May amounted to 3.8 million (m) tonnes, a glaring contrast to the 8m tonnes exported in April. Jan-May export volumes are up 10% compared to the same period last year.

The sharpest decline was seen in exports of aviation kerosene, also known as jet fuel, which dropped by 1.4m tonnes from 1.9m tonnes in April to 0.6m tonnes in May, a 72% decline. Exports of gasoline and diesel oil also dropped significantly by 64% and 44% respectively.

The Great Lockdown causing plunge in oil demand

The oil market has endured volatility on an unprecedented scale in 2020, driven by simultaneous supply and demand shocks. The US Energy Information Administration (EIA) estimates that oil demand in May dropped by 17 million barrels per day compared to 2019, which partly explains the drop in Chinese refined petroleum exports during that month.

Oil product tankers worked overtime at a massive premium

Under ordinary circumstances, oil product tankers would feel the pain when Chinese petroleum product exports exhibit such a massive monthly drop. Yet, almost nothing in the oil tanker market in 2020 has followed along the usual market patterns.

The low oil prices had the oil tanker market working overtime, and the pickup in demand for floating storage caused a spike in earnings for crude oil tankers and product tankers.

However, with OPEC+ production cuts in motion since 1 May 2020, and oil prices gradually recovering, the profitability of the oil product tanker market has started to face mounting downward pressure.

Jump in crude oil imports and refinery activity

With a massive oil supply-demand imbalance in April and May, oil prices suffered. Chinese oil importers seemingly capitalized on the low prices which led to record-high crude oil imports of 47.9m tonnes in May, a 19% month-on-month increase. Unsurprisingly, crude oil processing at Chinese refineries followed along the same trajectory and jumped to 57.9 m tonnes in May, the highest level in the first five months of 2020 and second-highest level on record.

The high crude oil processing in May can be partly be attributed to the cheap oil in recent months but is also reflective of economic conditions China which have started to shore up. Whether the high output in May will translate into a proportional increase in refined petroleum products in June remains to be seen in the upcoming export data. However, anecdotal evidence suggests that one of the large Chinese oil majors has sought to limit seaborne exports of oil products in June.

Source:- Hellenic Shipping News