The 2021 Suez Canal blockage resulted in a loss of nearly $89 million for the shipping company Maersk Line. This is revealed in a new study conducted by a European research team in collaboration with the School of Business, Economics and Law at the University of Gothenburg. The methodology can also be used to analyse the ongoing crisis in the Red Sea.

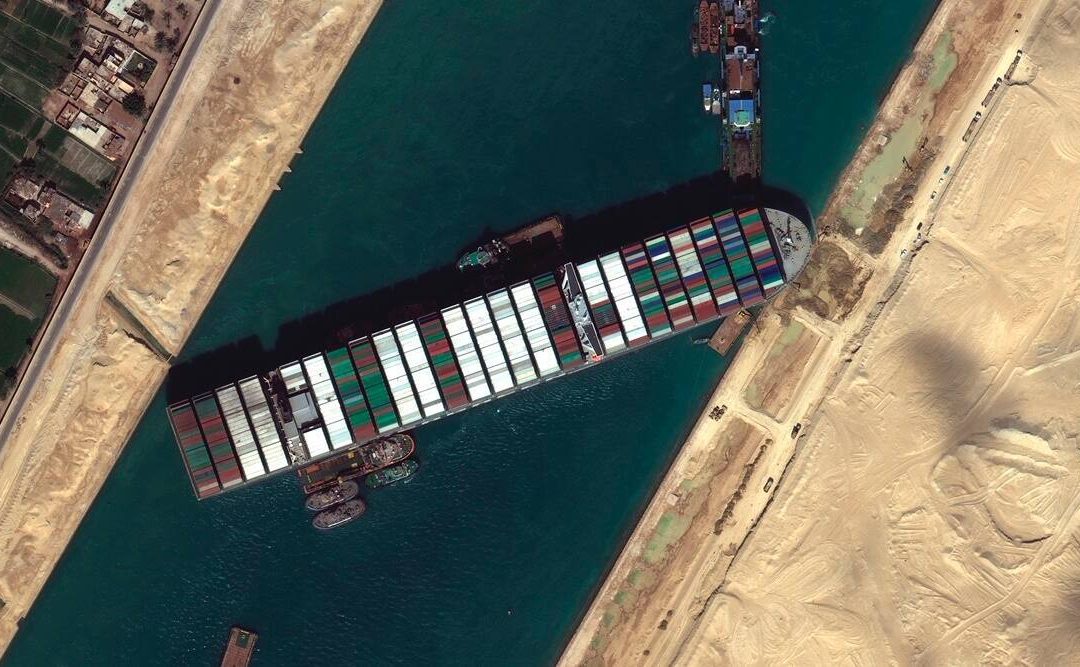

On 23 March 2021, the container ship Ever Given ran aground in the Suez Canal. The blockage lasted six days and caused significant logistical disruptions worldwide. Around four-fifths of international trade is carried by sea, and on an average day around 50 container ships pass through the Suez Canal.

Alternative transport routes

By analysing ship data, the research team developed a model to calculate the economic and environmental consequences of disruptions in maritime logistics.

“The blockage highlights the vulnerability of our global supply chains and the huge costs that can result from a disruption. Our findings underline the need for robust contingency plans and alternative transport routes to minimise future risks,” says Prof. Kevin Cullinane (The School of Business, Economics and Law at the University of Gothenburg).

Inventory holding the largest expense

The study’s results are based on data from Maersk’s fleet, which accounts for one-third of all commercial ships affected by the blockage. A total of 69 of the company’s ships were impacted, either through rerouting via the Cape of Good Hope or because of delays at the Suez Canal.

“The research shows not only the significant economic risks in international logistics, but also the substantial impact that disruptions have on day-to-day operations,” says Prof. Hercules Haralambides (Dalian Maritime University, Erasmus University Rotterdam, Sorbonne Centre for Economics).

Of Maersk’s total loss of $89 million, the cost of holding container inventories was the largest expense at $76 million. Ship costs and environmental costs accounted for the remainder.

Increased carbon emissions

Ship costs are calculated by summing the daily capital, operational, container, and fuel costs during the period of the blockade. Environmental costs are calculated by multiplying the amount of additional carbon dioxide emissions by $100 per tonne of CO2, which is the European Commission’s standard external cost for the transport sector. The blockage increased the carbon dioxide emissions of Maersk’s fleet by 44,574 tonnes due to longer voyages and waiting times. In addition, the Suez Canal Authority lost $5.9 million as a result of the ships’ detours.

Due to confidentiality, the researchers did not have access to data from all container ships affected by the blockage.

Analysis method for other crises

The study’s methodology can be applied to other logistical disruptions, such as those currently occurring in the Red Sea due to attacks on cargo ships by Houthi rebels. Many ships are now being rerouted around the Cape of Good Hope, and shipping companies are being forced to change their usual route via the Suez Canal.

“Given the large number of ships being rerouted over an extended period of time, the consequences are much greater now, both in terms of inventory holding costs and carbon dioxide emissions. Researchers can use our framework to analyse the additional costs of this major disruption to global maritime trade,” says Prof. Theo Notteboom (University of Antwerp, Ghent University, Antwerp Maritime Academy).

Source: School of Business, Economics and Law at the University of Gothenburg