The conflict in Eastern Europe and covid flareups in China are adding more stress to the already strained global supply chain.

In this month’s topic, we would like to shed further light on the impact of the current global situation on trade within and with Latin America and how Maersk is continuing to help our customers through difficulties. Additionally, we’ll explore the current economic scenario, the main commodities imported and exported, and the possible economic impacts.

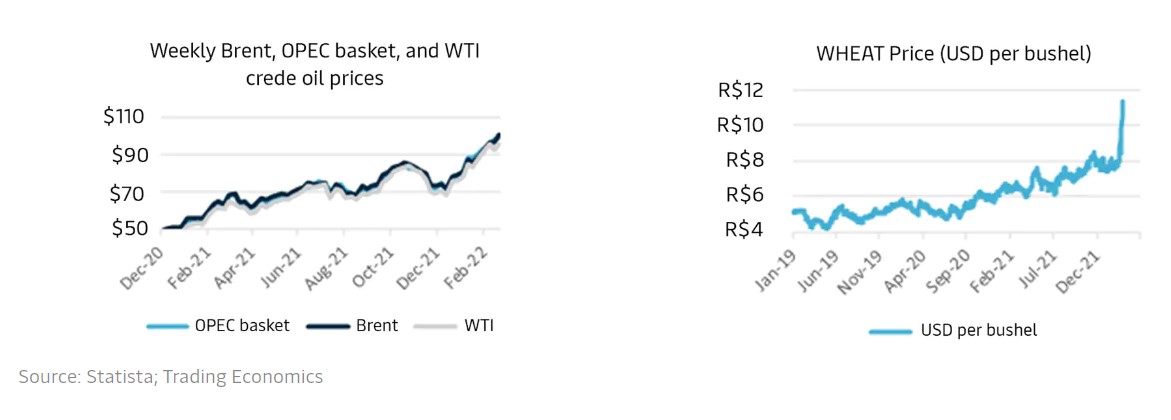

The global economy is again facing challenges as the conflict in Eastern Europe continues. Energy prices have surged; oil prices are already being negotiated above $100 per barrel. Intercontinental Rail and Air freight are impacted, with ICR no longer taking on bookings and airspace restrictions affecting Air freight routes. Ocean bookings are being suspended in the region by many companies.

Commodities are also being affected, with wheat prices reached the highest price in 14 years. Both Russia and Ukraine account for a large component of the wheat 14%, barley 19%, and corn 4%, ingested across the globe, adding up to more than one-third of the global cereal. Their output is used to feed at least 50 countries across the globe, many of which include the least developed nations, according to the Food and Agriculture Organization of the UN (FAO).

Russia is a major global producer of fertilizers, including nitrogen, phosphorus, and potassium, all of which are essential for crop agriculture. Due to the rising conflict in the region, there are legitimate worries that there will be shortages and issues with yields, not only in Ukraine and Russia, but globally as farmers all around the world will be impacted by the Eastern European supply shortage. Adding to the situation is increasing energy prices affecting the cost of transportation of the commodities that have been produced.

Not only is the above a worry, but so is the semiconductor and chip industry. Prior to the ongoing conflict in Eastern Europe, the world was already facing chip shortages. This situation could be made worse by the ongoing crisis.

Ukraine is a major producer of neon, and Russia is a key producer of nickel, platinum, silver, and palladium, the latter which Russia produces 45.6% of the world’s used. All are essential ingredients in the semiconductor industry. Industry experts are worried that semiconductors industry will grow with 50% in the coming four years. Should the situation continue to evolve the way it is, prices for semiconductors and semiconductor materials will continue to rise in price, in response to shortage in supplies.

The effects on Latin America

Latin America has a modest commercial trade balance with Russia in most of the countries, accounting for less than 1% of the total imports and exports of the region. However, some countries in the region are highly dependent on fertilizers.

In 2021, Brazil was the biggest importer of fertilizer from Russia. Of all fertilizers imported to Brazil, 62% them were from Russia. Difficulties in importing those products may affect the productivity of plantations and increase the price of commodities like soy, corn, coffee, and sugarcane. Protein prices, in turn, may also be under pressure, as the basis of animals’ diet is grains.

In 2021, Argentina also relied on Russian fertilizer, although to a smaller portion (Russia representing around 10% of the imports) as they have a more diversified number of suppliers.

On the export side, Mexican exports to the Russian market were made up mainly of cars and gearboxes, as well as certain electrical machines and appliances, copper products, beer, and sugar. In 2020 Ecuador provide almost 96% of all bananas imported to Russia.

While a price increase seems to be inevitable in many sectors (oil and other commodities), it might be too soon to have a clear outlook of what is going to happen and the possible mid-term economic implications, not only in Latin America but also at a worldwide level.

Covid flareups in China

Covid is still playing a substantial role in disrupting global supply chains. We see pockets of improvements, only to get setbacks when key sites encounter a COVID-19 outbreak and renewed lockdowns. China has been dealing with Covid flareups in key manufacturing hubs, affecting production as well as import and export. Supply chains are finely tuned, sensitive ecosystems, where one ripple can be felt throughout the chain.

Chinas’ zero Covid policy is coming with a big economic cost. In mid-March, more than 21 cities including Beijing, Shanghai and Shenzhen were in lockdown. Currently more than 26 million people are in lockdown in Shanghai as China faces the worst outbreak since January 2020. The Caixin services Purchasing Managers’ Index (PMI) indicated that March also had the sharpest decline in two years.

Maersk is closely monitoring the situation in China, and business contingency plans have been activated.

Maersk aims to give you the best ability to manage your supply chain and we are working to provide the information you need to do so. Throughout this process, our objective is to give as much clarity and notice as possible, so please visit this advisory page where the latest situational updates will be added daily. As a Maersk customer you can also access our Logistics Hub to make use of our interactive map functionality and AI-powered analysis to predict more accurate estimated times of arrival (ETA).

It is key for Maersk that we protect our people, minimize supply chain disruption, and do not add to the global congestion in ports and depots. We will keep monitoring the situation and reviewing impacts from sanctions, with an ambition to stabilize operations as quickly as we can. Please don’t hesitate to contact our Maersk Customer Experience teams, which are ready to discuss options and solutions for your cargo.

Source: Hellenic Shipping News